All Categories

Featured

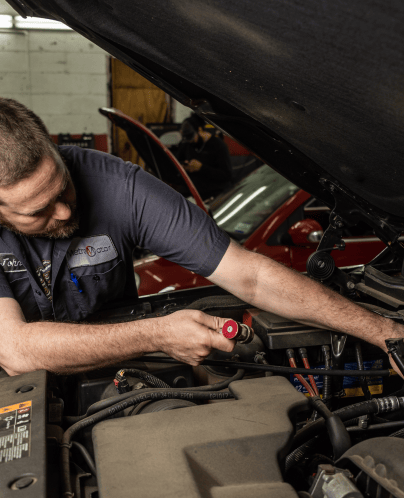

Car repair services can be a significant financial concern, particularly when the repairs are unanticipated or substantial. Whether your car needs a brand-new transmission, engine job, or considerable body repair work, the costs can accumulate quickly. There are a number of funding alternatives available to aid ease the monetary stress. When faced with significant vehicle fixings., Below are some of the best funding alternatives to take into consideration.

- Car Repair Service Shop Funding. Lots of automobile repair stores provide funding alternatives straight to clients, permitting you to pay for repairs over time. These strategies are typically tailored to aid you handle the expense of large repairs, and they might provide special bargains like deferred rate of interest or interest-free periods.

Pros: Easy to gain access to, as the funding is given by the fixing shop itself. It can be a fast remedy when fixings are immediate, and some stores provide zero-interest promotions for a particular duration. Disadvantages: Rates of interest might increase after the promotional duration, so it's vital to check out the small print. In addition, not every service center offers this choice, and the terms and accessibility can vary. 2. Personal Loans. If you require more versatility, personal car loans from a bank, lending institution, or on-line loan provider may be a superb choice for financing your automobile repairs. These financings use taken care of terms and reduced rate of interest than charge card, and they allow you to obtain larger quantities.

Pros: Taken care of rate of interest and foreseeable monthly repayments make budgeting less complicated. Individual finances also use versatile lending amounts, which is useful for substantial repairs. Cons: Authorization for individual lendings often relies on your credit history. If your credit history is less than stellar, you may get a higher interest rate, which can boost the overall expense of the financing. 3. Credit Cards. Utilizing a charge card is among the quickest methods to spend for auto fixings. If you already have a credit card with a low-interest rate or a 0% APR promo, this alternative can be quite cost effective. Some credit rating cards also offer benefits, which can be a wonderful incentive.

Pros: Quick access to funds, and if you have a 0% APR offer, you can repay the balance with time without accruing rate of interest. Some cards likewise offer incentives or money back. Disadvantages: Rates of interest can be high after the advertising duration ends. The passion fees can add up quickly if you carry an equilibrium. Missing settlements might negatively impact your credit scores score. 4. Home Equity Lending or HELOC. You may think about a home equity car loan or line of debt (HELOC) if you have your home and have significant equity. These loans allow you borrow against the value of your home and commonly supply lower rates of interest contrasted to personal car loans or bank card.

Pros: Lower interest prices and longer payment terms than other funding choices. Home equity fundings often supply accessibility to larger amounts of cash, which can be valuable for substantial repairs. Disadvantages: You're using your home as security, so if you fail to repay the financing, you run the risk of losing your residential property. The authorization process might take longer compared to individual lendings or bank card. 5. Car Repair Service Loans. Some lenders specialize in automobile repair work lendings, developed particularly for car-related expenses. These loans can be made use of for fixings such as replacing a timing belt or taking care of a broken transmission. They operate in a similar way to individual financings yet are meant for car repair demands.

Pros: Lower rate of interest rates compared to bank card, and the loan is tailored for cars and truck repair work, so the application procedure might be quicker and a lot more simple. Cons: You might need a great credit rating to qualify for the finest rates. Additionally, the loan amount might not suffice for considerable repairs in all instances. 6. Insurance Coverage. In many cases, vehicle repairs might be covered by your insurance policy, particularly if the damages is connected to a crash. Comprehensive and accident coverage can assist pay for pricey repairs, though you may still need to pay a deductible.

Pros: Repair services connected to accidents or occurrences covered under your policy are cared for without needing to pay out-of-pocket (aside from the deductible) This is particularly helpful for major fixings after a collision. Disadvantages: Not all repair work are covered, and the insurance deductible can still be expensive. Plus, insurance policy prices may raise after you submit a case. 7. Payday Advance (Not Advised) While payday financings could appear like a quick way to cover repair service prices, they feature incredibly high-interest prices and charges. These finances are temporary and call for repayment in complete, usually within a couple of weeks.

Pros: Quick access to funds in emergency scenarios. Disadvantages: Extremely high-interest prices and charges can make it challenging to pay back the funding on schedule. Payday advance typically develop a cycle of financial debt, and stopping working to repay can negatively impact your economic scenario. 8. Technician Repayment Strategies. Some car service center supply layaway plan that permit you to spread the cost of the repairs with time. These plans may include interest-free periods or low month-to-month repayments, which can make big repair service expenses much more manageable.

Pros: Versatile terms and interest-free payments if paid off within a specified amount of time. Disadvantages: Not all shops offer layaway plan, and terms differ. Make certain to verify the payment schedule and any type of fees or fines that may apply. Conclusion. Selecting the very best financing choice for car fixings relies on your particular circumstance. Vehicle repair store financing, individual loans, and charge card use benefit and flexibility, while home equity finances and automobile repair work financings give accessibility to bigger sums of cash. Constantly compare rates of interest, financing terms, and charges before choosing to make certain that you are picking the most affordable option for your needs.

Latest Posts

Discover Budget-Friendly Auto Repairs with Montclare’s Exclusive Service Specials

Published May 30, 25

1 min read

Learn About Brake Repair & More: Comprehensive Auto Care Solutions from Montclare Auto Repair

Published May 22, 25

1 min read

Why Routine Vehicle Maintenance at Montclare Auto Repair Saves You Money

Published May 22, 25

1 min read

More

Latest Posts

Discover Budget-Friendly Auto Repairs with Montclare’s Exclusive Service Specials

Published May 30, 25

1 min read

Learn About Brake Repair & More: Comprehensive Auto Care Solutions from Montclare Auto Repair

Published May 22, 25

1 min read

Why Routine Vehicle Maintenance at Montclare Auto Repair Saves You Money

Published May 22, 25

1 min read